Forecasting Done Right

Various thoughts on forecasting

Introduction

There is no doubt that regardless of whatever area of quant you end up in, you will end up having to do some degree of forecasting. Whether that is forecasting returns (for stat arb strategies), funding rates (for funding arb strategies), volumes (for execution strategies), or even parameters is a vol curve, it is a problem that comes up time and time again in the work of quants. Today, Quant Arb and I are going to be walking through our thoughts on how to do forecasting properly with some practical tips. We focus primarily on return forecasting in a statistical arbitrage manager context.

[This article is available to readers of either of our publications in it’s entirety so feel free to subscribe to either!]

Index

[Quant Arb] - Modelling and Construction

Introduction

Index

What are we forecasting

Implicit Forecasts (and why they work!)

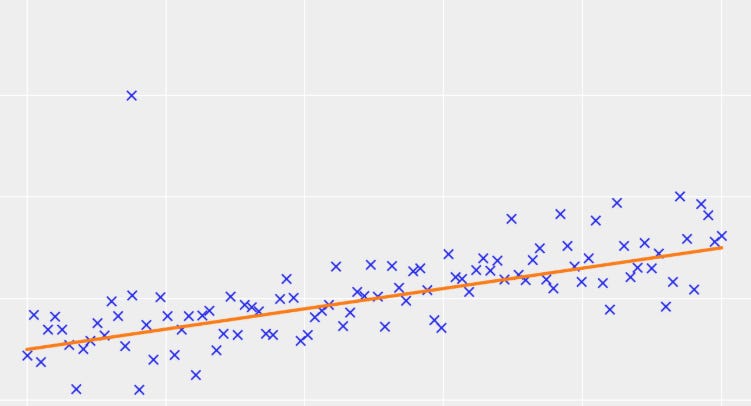

Models

Features come first

What doesn’t work

Dropping features at the model level

Dimensionality reductions

Lots of bad features

Forecasting isn’t the best edge…

[Systematic Long Short] - On Combining Forecasts

The Limits Of Diversification

Optimal Forecast Weighting

When Forecast Combining Breaks Down

A Few Simple Heuristics…